What can we learn from the Used Vehicle Retail Summit?

3 juli 2025, PaulThis week, I had the opportunity to speak at the Used Vehicle Retail Summit in Frankfurt on my favorite topic: lead follow-up and the six steps to achieve higher—and therefore better—conversion! The great thing is that I can increasingly include my own experiences in these presentations (just before leaving, I sold a car to an online lead). That makes the message come across much more effectively.

What stood out to me during the Summit—after hearing many presentations on AI—was how important it is to manage your used car inventory in a data-driven way.

I personally use Indicata, and Andy Shields from Indicata emphasized in Frankfurt how crucial it is to define your online pricing strategy based on data.

I’m not a fan of adjusting prices daily by small amounts; I prefer round numbers. That’s why we change prices in steps of a thousand euros. But the essence of his message definitely stuck with me.

Indicata Data

I use Indicata · Global, and Andrew Shields from Indicata emphasized in Frankfurt how important it is to define your online pricing strategy based on data.

I’m not a fan of adjusting prices daily by small amounts; I prefer round numbers. That’s why we change prices in steps of a thousand euros. But the essence of his message definitely stuck with me.

With the help of Indicata, we classify our vehicles into three categories: gold, silver, and bronze. The goal is to sell all used cars (excluding microcars) within 30 days.

Gold

Gold cars have a Market Days Supply (MDS) of 60 days. In the first month, I ask 103% of the market price, the second month 101%, the third month 99%, and the fourth month 97%. These are cars we actively source and purchase.

Silver

Silver cars have an MDS of 60 to 120 days. In the first month, I ask 100% of the market price, the second month 98%, the third month 96%, and the fourth month 94%. These are usually trade-ins that we don’t (yet) pass on to B2B.

Bronze

Bronze cars have an MDS of 120 days. In the first month, I ask 95% of the market price, the second month 93%, the third month 92%, and the fourth month 90%. If these aren’t sold in the first month, they go directly to B2B—even at a loss—because the data shows I would otherwise hold onto them for too long.

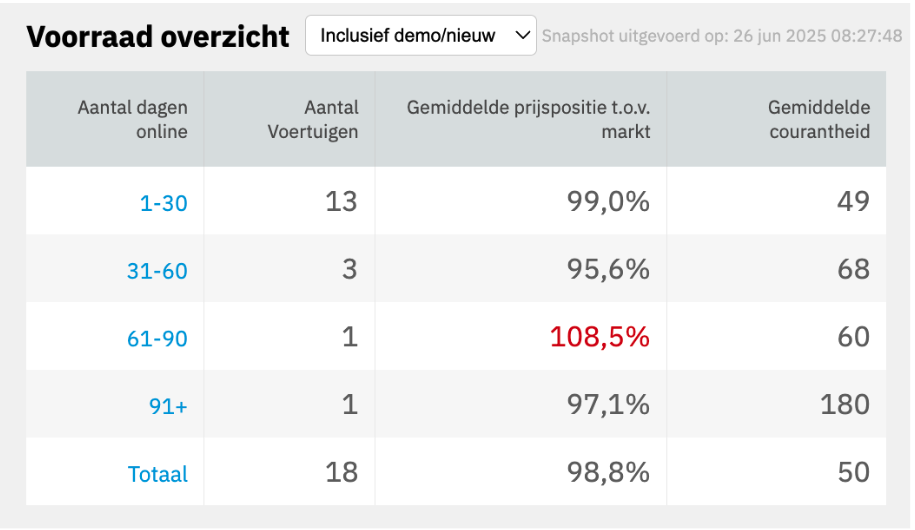

If you now look at our cars in Indicata (unfortunately, microcars are excluded), the inventory looks like this:

You’ll see almost only “gold” cars and one silver car still within the 30-day window. I’m making two mistakes here: because of the high turnover, I’m asking too little—namely 99% and 95.6% of the market price. And for that one car that isn’t moving, I don’t want to take the loss yet; I’m stubborn and want to “get my own money” for it. You might say: “Nice, but it’s only a few cars…” That’s true, but the vision is clear; now I need to ensure solid execution.

That’s why it’s extra motivating that this week, with the data and real-world experience I’ve gained, I saw my approach confirmed by Andy Shields in Frankfurt! Onward to better results.